Real Estate investments are always among the popular choice for people looking to expand their wealth. Though, with a variety of choices available, it is challenging to spot the best property investment opportunities.

As the location is one of the most critical factors in property investment, properties situated in areas with a high flow of demand and limited supply tend to appreciate in value over time. Such properties are considered as best property investment opportunities for future wealth expansion. According to the recent statistical figures given by the BBC website, London has long been one of the most popular areas for property investment, with an average annual increase in house prices of 3.3% between 1983 and 2019.

However, other areas like Manchester and Liverpool have seen a significant increase in the property market. The average house prices increased by 17.2% and 16.2%, in Manchester and Liverpool respectively, between 2015 and 2020.

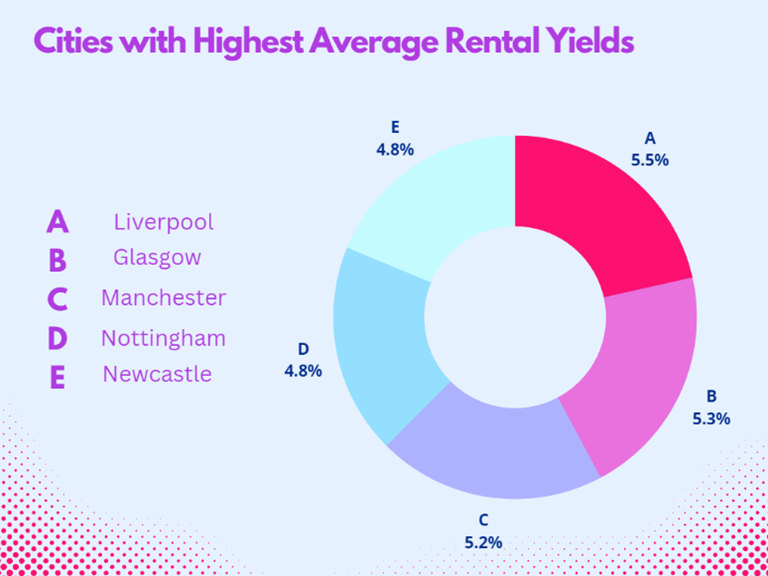

According to property data report 2021 by Zoopla, the following cities in the UK offer the highest average rental returns –

As a potential investor looking to invest in real estate in the IUK, it’s essential to spot the best investment opportunities to achieve your financial aims. As a variety of properties are available to choose from, the advantages and disadvantages based on your investment also vary. For example, making investments in commercial properties may yield higher rental returns compared to residential properties, but investing in student accommodation may provide a steady source of rental income. According to a report published by the BBC website, the UK’s section of private rented properties has grown by 63% since 2007, making it an increasingly popular choice for property investors.

Along with location, external factors like changes in interest rates, governmental policies, and economic conditions can impact property prices. The pandemic hit significantly led to a decline in UK house prices by 0.3% in 2020. However, there is a recovery spottable since 2022, with house prices increasing by 6.9% as mentioned by the BBC website. It is always advisable to keep track of such on-and-off trends and align them with your investment strategy.

It is also important to understand the right goal for investing in real estate as it affects the choices of what kind of property one should go for. For instance, according to data from the HomeOwners Alliance, flats are the most popular type of investment property in the UK accounting for 40% of all buy-to-let purchases.

Lastly, it’s crucial to consider the potential for capital growth when investing in real estate in the UK. Though rental income offers steady returns, long-term gains often come from capital appreciation. According to a report by BBC, UK house prices have increased by an average of 2.7% per year since the year 1975, focusing on the potential for long-term gains in real estate investment.

To conclude, investing in real estate in the UK requires strategic planning that considers various factors, such as location, type of property, external factors, and of course the potential for capital growth. By consulting with an investment real estate company that can provide valuable insights and guidance, one can identify the best investment opportunities and build a profitable yet diverse real estate portfolio over time.