UK Build To Rent (BTR) sector is continuously rising and achieving new heights. Investment

opportunities are very high in this sector due to the rise in demand for rented homes with easy

maintenance. Institutional and Retail Investors are investing Billions of Pounds in this sector for

stable returns for a long period of time…

Growth Factors

- High rental growth due to high demand and shortage of supply in UK Homes.

- High Inflation in recent years.

- People are more interested in rental homes compared to the past due to affordability issues.

- People are open to moving to different big cities because of better job opportunities

- People are looking for a high-quality home that meets their needs and a good service in the rental industry

- Covid-19 has also changed the mindset of people. They are more interested in private rental properties for themselves instead of sharing with other people on a rental basis.

- UK is a desirable location to live in for people from all over the globe.

Investment in Build to Rent

As per British Property Federation and Savills survey existing investors were particularly active in 2021. However, in addition, the pool of investors looking to access the market is deepening. New Investors are also taking a keen interest in this market and investing in new projects in this sector, a move which has intensified competition to either create or acquire stock.

As per Development Finance Today Magazine big property developers are entering the Build To Rent Sector i.e. Strawberry Star Group, The Harlow development.

The government last December increased housing targets by 35% in 20 cities selected for additional growth. The cities are #London, Birmingham, Liverpool, Bristol, Manchester, Sheffield, Leeds, Leicester, Coventry, Bradford, Nottingham, Kingston upon Hull, Newcastle upon Tyne, Stoke-on-Trent, Southampton, Plymouth, Derby, Reading, Wolverhampton, Brighton, and Hove.

Current Build To Rent Market Status

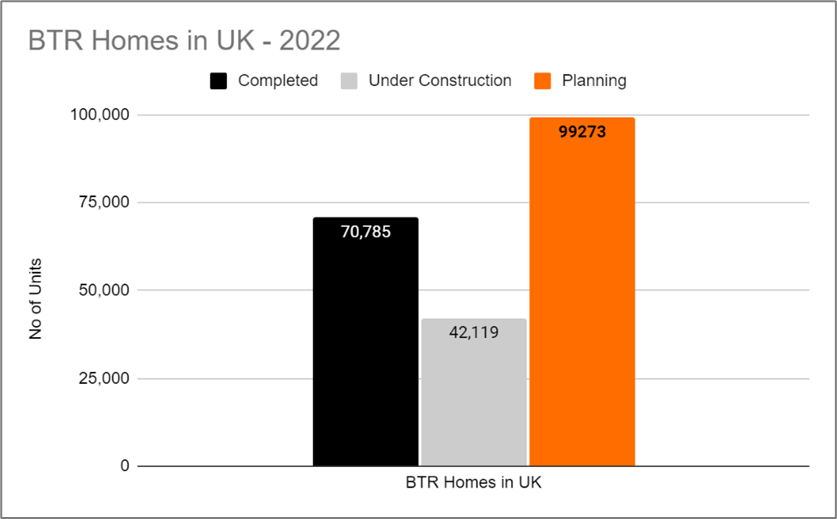

New analysis from British Property Federation (BPF) shows there are now 212,177 build-to-rent homes in the UK, including both London and the regions, of which 70,785 are complete, 42,119 under construction, and 99,273 in planning.

Penny Davidson, an Associate Director of Residential Valuations in CBRE said: ” The BTR market is gaining momentum and this is further demonstrated with some key changes to our Prime Regional and Other Regional Centre yields.”

How to Invest in Build to Rent

Build to Rent isn’t just for well-known developers. Individual property investors can also take advantage of the sector’s potential. If you want to know more about investment opportunities in the Build To Rent (BTR) sector in London and the southeast, we can certainly help you with that!

At PLMD Group we offer property investors the opportunity to invest in a share of the rental income that we produce from our multiple sites. We have more than 70 real estate assets under management and more than 20 years of experience in real estate development & management. We are always on the lookout for undervalued real estate and land with the potential to become a high-value development and provide a solid return on investment in this Build To Rent Sector.

If you’re interested to find out more, please get in touch or email our investment team at invest@plmd.co.uk. We would love to tell you more about our exciting investment opportunities! #PropertyInvestment #PropertyDevelopment #Property #UKProperty #BuildtoRent #PropertyFinance #PLMDGroup